The Global Market:

Key Players and Dynamics

Diamonds follow a structured path: extraction, cutting, certification, and distribution. Rough stones, extracted in regions such as southern Africa, Russia, or Canada, are first resold via auctions by major producers like De Beers or Alrosa.

They are then cut by experts, often in India, Belgium, or Israel, before being certified by independent laboratories. The diamonds subsequently circulate on specialized exchanges such as Antwerp or Dubai.

The diamond trade is strictly regulated by international laws and the Kimberley Process, which combats conflict diamonds. Thanks to global databases and advanced traceability tools, the provenance of stones is assured, enhancing transparency throughout the market.

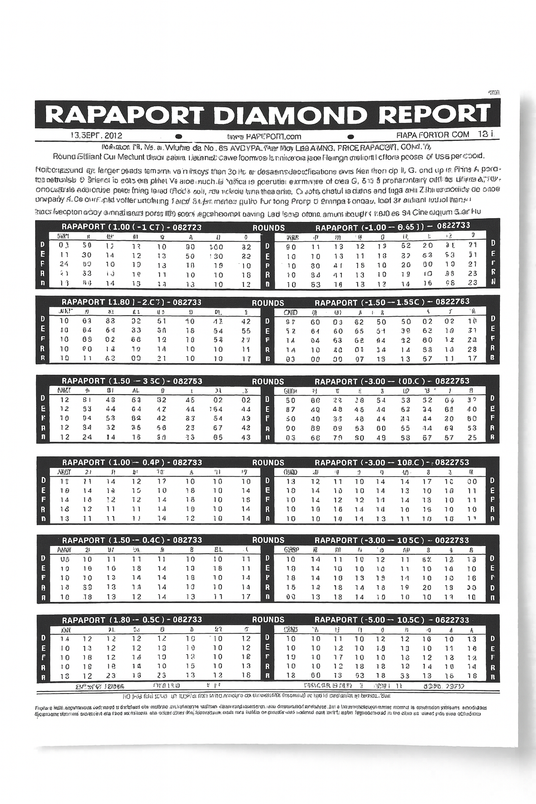

THE RAPAPORT:

the benchmark price index

The Rapaport Diamond Report, created in the 1970s by Martin Rapaport, is now the world’s leading pricing authority for polished diamonds. Published weekly, this chart provides indicative prices in US dollars based on the 4Cs (carat, color, clarity, and cut).

It serves as a basis for international pricing, functioning like an official price list. Although final prices may vary depending on rarity or negotiations, the Rapaport remains a tool of transparency, stability, and trust—especially for investors.

It is the industry professionals’ benchmark: a reliable reference for comparing, estimating, and investing accurately.